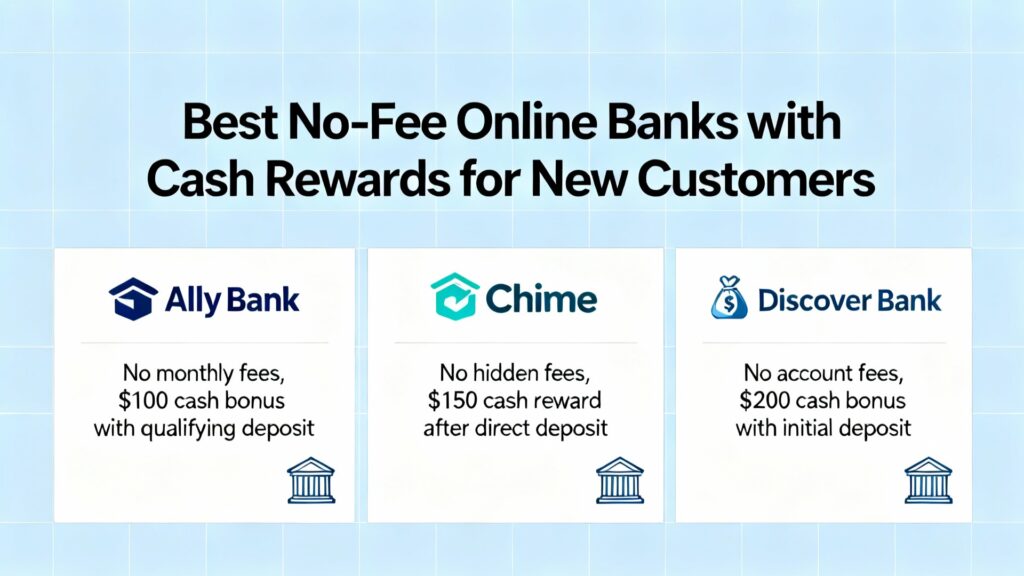

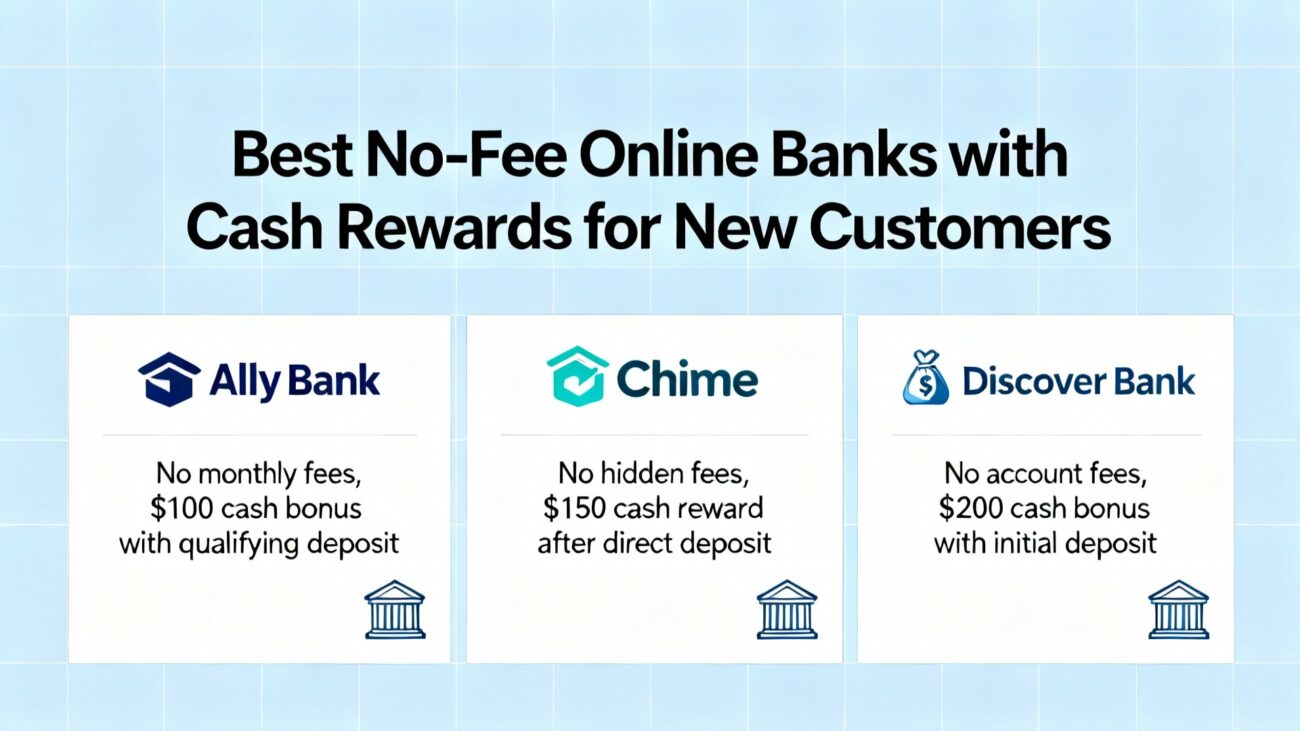

Best No-Fee Online Banks Offering Cash Rewards for New Customers

Why No-Fee Online Banks Are Becoming the New Normal

When I look at how banking has changed over the last decade, one thing stands out:

People are done paying fees.

I personally reached a point where I refused to hand over money to a bank every single month just to have an account. That frustration pushed me into exploring the world of no-fee online banks, and what I discovered completely changed how I handle my financial life.

Online banks today offer more than convenience. They offer:

- No monthly fees

- High APY savings

- Instant notifications

- Modern mobile apps

- And the best part: cash rewards for new customers who sign up

That means you’re not paying them — they’re paying you.

In this article, I’ll walk you through the best no-fee online banks that offer cash rewards for new customers, how these rewards work, and why these accounts are worth it if you’re trying to save money, fix your budget, or start building financial stability.

This guide is evergreen, beginner-friendly, and designed to rank in search engines for the long term.

Let’s get started.

SIGNUP WITH THIS ONE AND THEY WILL PAY YOU $100 !

Table of Contents

Why No-Fee Banks Can Afford to Give Cash Rewards

When I first started reviewing online banks, I wanted to understand how they could offer cash bonuses when traditional banks wouldn’t even waive a $12 monthly fee for me.

The answer is simple.

1. Online banks don’t pay for branches

No buildings

No tellers

No rent

No maintenance

No overhead

Those millions in savings become cash rewards for customers.

When I first started searching for the best banks with no fees, I realized how confusing banking can be. Almost every bank advertises itself as “free,” but once you open the account, fees start appearing everywhere. That’s what pushed me to really research which banks with no fee policies actually mean it, not just in marketing but in real everyday use.

What surprised me the most is how many traditional banks still rely on fees as their main source of income. Monthly maintenance fees, overdraft fees, minimum balance fees — it adds up fast. That’s why I personally prefervstarted focusing on banks without fees, especially online banks that don’t nickel-and-dime you just for accessing your own money.

Over time, I learned that zero fee bank accounts are much more common in online banking than in traditional branches. Online banks don’t have physical locations to maintain, which allows them to offer no fee online banking without cutting corners or charging hidden costs. For me, that’s a huge win.

When someone asks me what makes an online bank account with no fees better, my answer is simple: peace of mind. I don’t have to worry about forgetting a minimum balance or getting charged just because my paycheck was late. That’s exactly why I prefer online banking with no fees over old-school banking.

After testing multiple banks, I kept asking myself: what is the best bank with no hidden fees? The answer always came down to transparency. A truly fee-free bank clearly states that there are no monthly fees, no overdraft fees, and no minimum balance requirements. If a bank hides its fees in fine print, it’s not worth my time.

From my experience, the best bank accounts with no fees are almost always online-only banks. They don’t rely on penalties to make money. Instead, they focus on building long-term customers by offering better tools, cleaner apps, and truly zero fee banking experiences.

One bank that consistently stands out when people ask me about the best bank with no fees is Varo. They don’t charge monthly fees, they don’t require minimum balances, and they don’t surprise you with random charges. That kind of transparency is rare, and it’s why I recommend them so often.

If you’re looking for a no fee bank that actually keeps things simple, Varo is a strong option to consider. You can open the account without worrying about hidden charges, and everything is managed easily through their app. You can check it out here:

Many people still ask about best brick-and-mortar banks with no fees, and while a few exist, they usually come with conditions. You might need a direct deposit, a high balance, or specific account activity. That’s why I personally lean toward online banks, where banks that don’t have fees are the norm, not the exception.

What I’ve noticed is that banks with no hidden fees are very clear upfront. They don’t rely on overdrafts or penalties to make money. Instead, they focus on offering better interest rates, cashback, or bonus incentives — which is much better for everyday users like me.

When comparing options, I always look for the best bank account with no fees that also offers extra value. That could be high-yield savings, early direct deposit, or cashback rewards. A truly fee-free bank should help you grow your money, not slowly drain it.

At the end of the day, choosing banks that don’t have fees is one of the smartest financial decisions I’ve made. I keep more of my money, avoid unnecessary stress, and don’t feel punished for normal banking activity. If you’re tired of paying fees, switching to a true zero-fee bank can make a bigger difference than you think.

2. It’s cheaper for banks to pay YOU instead of paying for ads

A $50 or $100 signup bonus is cheaper than marketing costs.

3. Online banks want long-term customers

Once someone opens an account and likes it, they usually stay.

4. Cash rewards attract the new generation of digital-first users

People want speed, convenience, and transparency — not fees.

This is why online banks are dominating the space with rewards that traditional banks simply can’t match.

What Makes a No-Fee Online Bank Worth It?

In my reviews, I always look for the same core features when choosing the best accounts. Here’s what matters most:

1. No monthly maintenance fees

No bank should charge you to hold your money.

2. No minimum balance requirements

You shouldn’t need $1,000+ just to avoid fees.

3. Easy, transparent cash rewards

The requirements should be simple and clear.

4. A strong mobile app

Fast transfers

Instant alerts

Mobile deposits

5. High APY on savings

A bank that pays you interest — not pennies.

6. FDIC insurance

Your money must be protected.

One of the few banks that consistently checks all these boxes is Varo, which is why I highlight them repeatedly in my guides.

1. Varo Bank – One of the Best No-Fee Online Banks With Cash Rewards for New Customers

I’ve tested countless online banks, and very few offer the complete package that Varo provides. It’s not just a bonus bank — it’s a no-fee, hassle-free, beginner-friendly system that makes everyday banking easier.

Why Varo Is My Top Recommendation

No monthly fees

Zero maintenance fees.

Zero minimum balance requirements.

Zero overdraft fees.

Easy-to-earn cash rewards for new customers

Varo frequently offers promotions that give real money for opening an account and completing simple steps. These rewards are legit and straightforward.

Cashback rewards on purchases

This makes Varo stand out — you earn bonus money AND cashback, something traditional banks rarely offer.

Early access to your paycheck

You can receive your direct deposit up to 2 days early.

High APY savings

Varo offers one of the strongest high-yield savings accounts available online.

A clean, modern mobile app

Fast transfers

Instant alerts

Easy card controls

Smooth interface

FDIC protection

Your money is fully insured.

Varo gives you the immediate perk (cash reward) and long-term value (no fees + high savings rate), making it one of the best no-fee banks available today.

Want to open a Varo account and qualify for cash rewards?

Why No-Fee Online Banks Offer Better Deals Than Traditional Banks

Traditional banks depend heavily on fees:

- Overdraft fees

- Monthly maintenance fees

- Minimum balance penalties

- ATM fees

- Transfer fees

Online banks don’t operate this way. Their business model is built on offering value, not fees.

Lower costs = better perks for you

This is why online banks offer:

- Higher APY

- Free ATM withdrawals

- Cash rewards

- Better mobile tools

- Faster transfers

And again: no fees.

How Cash Rewards for New Customers Actually Work

Most people don’t understand how easy it is to qualify for cash rewards, so here’s the breakdown.

1. Open the account online

Takes 3–5 minutes.

2. Complete a simple requirement

Usually one of these:

- Direct deposit

- Debit card purchase

- Keeping the account open

- Using the app

Online banks design these steps to be beginner-friendly — nothing complicated.

3. The bank verifies your activity

This takes a few days or weeks.

4. The reward cash arrives automatically

It shows up in your checking account like any other deposit.

And that’s it.

It’s one of the easiest financial wins available today.

What to Avoid When Looking for No-Fee Banks With Rewards

Yes, online banks offer great deals — but some are tricky. Here’s what I personally avoid:

1. Banks with hidden fees

If you see any fine print about fees, run.

2. Banks requiring large minimum deposits

You shouldn’t need $500+, $1,000+, or more.

3. Overly complicated requirements

Rewards should be simple and clear.

4. Long payout times

Waiting 90–120 days isn’t ideal.

5. Weak or glitchy apps

Your banking experience should be smooth.

The accounts listed here avoid all of these issues.

Why Cashback + Signup Rewards = The Best Banking Combo

One reason I highlight Varo so often is because it combines:

Cash rewards

New users get bonus money.

Cashback on purchases

Earn money on everyday spending.

High APY savings

Your money grows while you sleep.

This creates a powerful cycle:

Bonus → Cashback → High APY → More savings

It’s one of the easiest ways to build financial momentum without extra effort.

Open Varo to take advantage of the bonuses and cashback:

How I Use No-Fee Banks With Rewards to Build Automatic Savings

When I started using bank rewards, I created a simple personal rule:

I treat rewards like savings, not spending.

Every reward goes into a separate savings pocket.

I don’t touch it.

I let it grow.

Within months, this created a small emergency fund.

Within a year, it became something meaningful.

This is one of the easiest ways to start building savings if you struggle to put money aside.

How Many Cash Rewards Can You Earn in One Year?

A lot.

Most people have no idea they can legally and safely earn:

- $200

- $300

- $500

- Even $1,000+ per year

…just by opening multiple no-fee online bank accounts with rewards.

Checking accounts do not affect your credit score, and banks don’t penalize you for opening new accounts.

It’s one of the easiest side-income strategies.

Security: Why No-Fee Online Banks Are Safe

Many people still worry about whether online banks are safe, but the truth is:

They follow the exact same protections as traditional banks.

That includes:

- FDIC insurance

- Encryption

- Biometric login

- Fraud alerts

- Instant activity notifications

In my personal experience, online banks are actually safer because they notify me immediately if anything happens.

Final Thoughts: Which No-Fee Online Bank Is Truly Worth It?

After years of testing online banks, the ones worth your time all share the same features:

- Zero fees

- Simple cash rewards

- Fast approvals

- Great apps

- High APY

- Instant alerts

- FDIC protection

- Easy debit card usage

Among all the choices I’ve reviewed, Varo stands out as one of the strongest, most consistent no-fee online banks that offers legit cash rewards for new customers.

It’s beginner-friendly, modern, and perfect for anyone wanting to avoid fees while earning bonuses.

Если задумали поездку в Калининград, настоятельно уделите внимание безлюдным пляжам Калининградской области и купальному сезону в Балтийском море — здесь можно купаться уже с июня, однако температура воды зачастую прохладная. Для прогулок великолепно подойдёт пеший маршрут по Калининграду с посещением исторического района, кафедрального собора и обзорных площадок, а также стоит заглянуть в калининградский зоопарк — не забудьте уточнить режим работы и прайс билетов заранее. Полную информацию можно найти тут [url=https://superotvet.ru/]что делать в калининграде в дождь[/url] .

К тому же советую обратить взгляд на архитектуру Калининграда с примерами немецкого стиля и форт Дёнхофф с его фото, которые прекрасно подойдут для энтузиастов истории. Для удобного путешествия узнайте, как проехать до популярных мест, например, в Зеленоградск на электричке или до Рыбной деревни. Если разыскиваете, где вкусно позавтракать в Калининграде, множество кафе предлагают превосходные завтраки — прекрасный старт дня перед посещением достопримечательностей.